Need fresh thinking? Help is a few keystrokes away.

Working Full Time While Attending Class is the Norm for Most Returning Students

The ability to keep or replace a dependable full-time job during the height of the COVID-19 pandemic was nearly as essential to some workers and their families as staying healthy.

Whether living paycheck to paycheck or living comfortably, workers from every industry sector were at risk of their employment opportunities taking a hit. During a time of scarcity, would those who wanted to make a change be willing to give up their jobs to go back to school, or would they prefer to continue working full time?

LAVIDGE conducted a national adult education research study post-pandemic. The objective was to learn attitudes of adult learners and define segments that share those attitudes.

The study uncovered three key adult education consumer segments:

- Opportunist - Positive about the value of investing in education and the possibilities for trained workers. Believe college isn’t necessarily for everyone.

- Worrier - Aren’t sure where their career is going, concerned about the cost of education, believe their skills are out-of-date and feel like they chose the wrong career path.

- Planner - See value in education, have a career plan and feel responsible for supporting others financially.

This is the fourth in a series of articles in which we reveal several “Light-Bulb Moments” our post-pandemic research uncovered about adult learners.

Light-Bulb Moment 4: Working full time while attending class is the norm for most returning student

Adult students who responded to our research study predominantly plan to continue working at their current level while pursuing their education.

Planners, at 61%, were most likely to report their intent to maintain their current work level, with Opportunists close behind at 57% and Worriers just three percentage points behind them at 54%.

The percentage of respondents who “plan to work, but not as much” dropped significantly to 27%, 25% and 16% respectively for Planners, Worriers and Opportunists.

Even fewer among all three attitudinal segments selected “not sure” or “don’t plan to work” with Planners, at 6%, least likely to agree with either statement whereas Opportunists, at 13%, were most likely to agree. Worriers, at 9%, ranked neatly between the two.

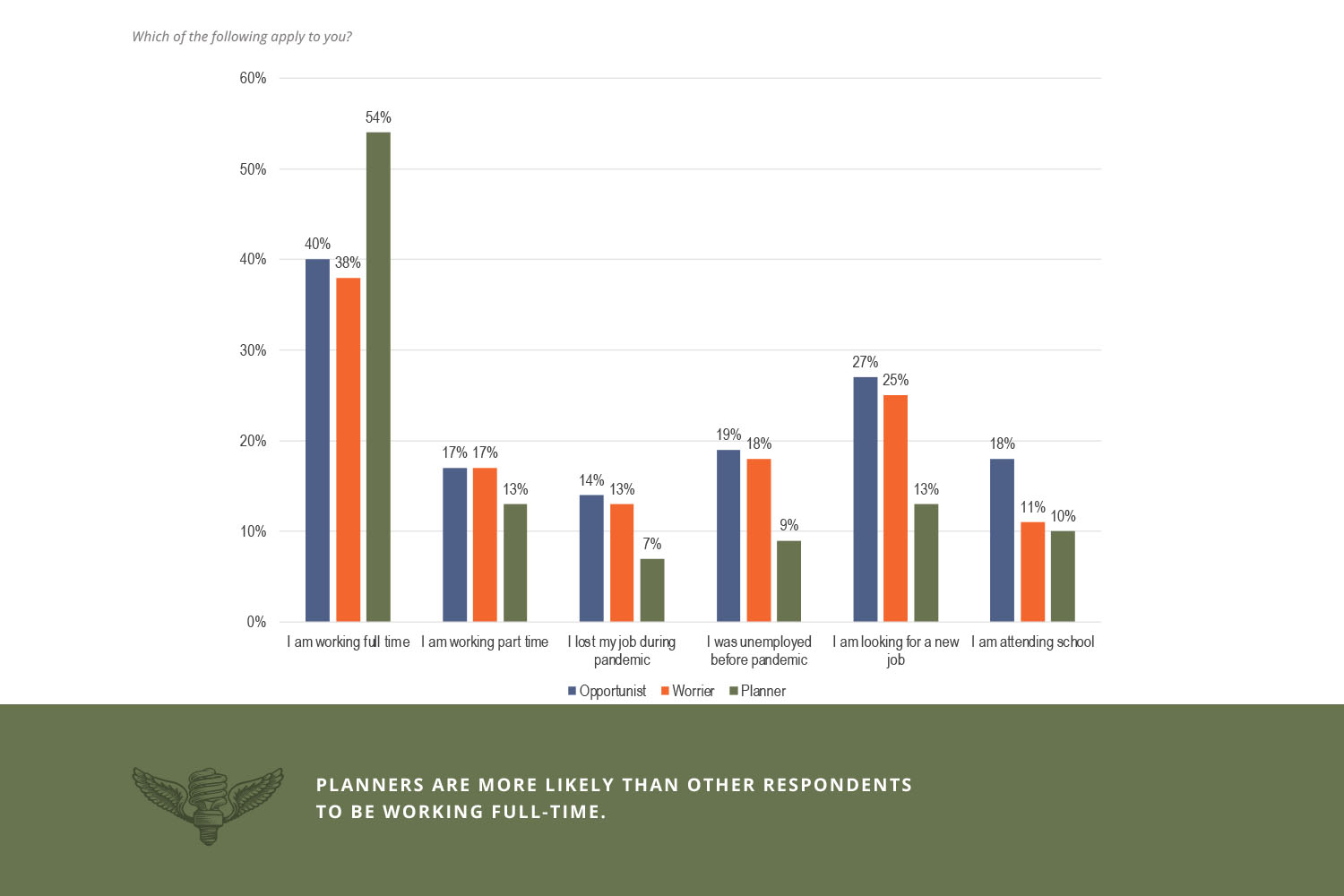

Planners, Opportunists and Worriers come from varying levels of employment

More than half of all Planners who responded to our survey said they are working full time. At 54%, Planners are more likely by 14 percentage points than Opportunists (40%) or 16 percentage points above Worriers (38%) to be currently working full time.

The spread between those who work part time within each attitudinal segmentation was much tighter. Among both Opportunists and Worriers 17% reported being employed part time. At 13%, Planners were least likely to have a part-time position.

Surprisingly, fewer people among all three segments who said they were unemployed reported losing their job during the pandemic than those who were not working before COVID-19 restrictions tightened the job market. Opportunists and Worriers, at 19% and 18% respectively, were among those already out of a job. Planners (9%) were least likely to have been unemployed.

A handful of previously employed persons did lose their positions during the pandemic. Once again, Opportunists and Worriers, at 14% and 13%, were most affected. Only 7% of Planners said they lost their job during the pandemic.

Among those who were out of work, about a quarter of all Opportunists (27%) and Worriers (25%) said they were “looking for a new job.” Perhaps because Planners were most likely to have a full-time role, only 13% of them agreed with the statement.

Some study respondents were already attending school before the pandemic. Opportunists, at 18%, were most likely to be enrolled along with 11% of Worriers and 10% of Planners also furthering their formal education.

Planners are more likely to seek education to further their current line of work

More than three-fourths of all Planners (77%) said after completing an education they would put any additional training to use in their current line of work.

That’s great news for companies interested in growing their workforce from within.

Employers who sponsor tuition costs might need to be a tad more concerned about Opportunists, 38% of whom stated they would use their new skills in a different line of work. Even so, more Opportunists (42%) indicated a desire to stay, along with 53% of Worriers who wish to remain in their current line of work.

Those who were “unsure” were in the minority with 22% of Opportunists, 18% of Worriers and 8% of Planners selecting this option.

Partner with an experienced adult education marketing agenc

Reaching potential adult learners who hold each of these beliefs—and targeting them one at a time for the best effect—requires attitudinal research. Going it alone, especially in a post-pandemic market, can be risky for educational institutions. Choosing the best agency to partner with has never been more important when it comes to creating consumer education marketing messages for adult learners.

Consumer attitudes are changing, and you need an experienced team with significant industry experience combined with access to developing consumer insight based on what your audience of learners believe.

You’ll find that—and more—with LAVIDGE.

In fact, education marketing is a core category at LAVIDGE. We invest in primary research to keep abreast of consumer shifts in the education industry, launching our first education study in 2018.

Finally, because our strong roster of current and past clients represents a wide range of organizations in the education category including Rio Salado College, Arizona Department of Education, CampusLogic, Arizona State University and International Sports Sciences Association (ISSA), it’s clear that LAVIDGE is an agency you can trust.

We’d love to bring you into the fold.

To learn more about our Adult Education attitudinal research study, contact Dave Nobs.

Footnotes:

“Career in Crisis,” a Brandeis University report published by The Heller School for Social Policy and Management noted: In April 2020, one month after the first states enacted stay-at-home policies, the U.S. economy experienced unprecedented losses in hospitality, retail, tourism, business, and related industries. The leisure and hospitality industry shed 47% of its jobs, the most impacted sector at the height of the pandemic, followed by the health care and education, and the professional and business services industries, which all lost over 2 million jobs.v

By the end of 2020, 15.8 million people were unemployed or underemployed.vi As of February 2021, the unemployment rate was 6.2%. This rises to 11.1% if we count workers that are unemployed or marginally attached to the labor force.

-

Franck, T. (2020) Hardest-hit industries: Nearly half the leisure and hospitality jobs were lost in April. CNBC. https:// www.cnbc.com/2020/05/08/these-industries-suffered-the-biggest-job-losses-in-april-2020.html

-

Bureau of Labor Statistics, U.S. Department of Labor. (2021). The employment situation—December 2020 (USDL-21- 0002; p. 44). U.S. Department of Labor.