Need fresh thinking? Help is a few keystrokes away.

The Pandemic Dramatically Impacted Attitudes About Education

LAVIDGE conducted a national adult education research study post-pandemic. The objective was to learn attitudes of adult learners and define segments that share those attitudes.

The study uncovered three key adult education consumer segments:

- Opportunist - Positive about the value of investing in education and the possibilities for trained workers. Believe college isn’t necessarily for everyone.

- Worrier - Aren’t sure where their career is going, concerned about the cost of education, skills are out-of-date and feel like they chose the wrong career path.

- Planner - See value in education, have a career plan and feel responsible for supporting others financially.

This is the second in a series of articles in which we reveal several “Light-Bulb Moments” our post-pandemic research uncovered about adult learners.

Light-Bulb Moment 2: The pandemic dramatically impacted attitudes about education

Attitudes about education are dramatically impacted by the pandemic

Worriers were more likely during the pandemic than Opportunists or Planners to change their thinking about education, but they were not alone. At 67%, more than half of all respondents indicated such was the case

While Worriers accounted for the majority of those who answered in the affirmative on this point, at 41%, more respondents from this attitudinal segment said their thinking was affected “to some degree,” compared to 34% of Worriers who selected “definitely” as their response.

Worriers also accounted for the lowest percentage of respondents whose thinking was “not really” affected (20%) and barely registered (5%) in the “not at all” category.

Category results for Opportunists and Planners indistinguishable by numbers alone

Percentagewise, results for Opportunists and Planners are identical.

The strongest attitude shared by both showed 34% of each segment reporting that the pandemic did “not really” affect their thinking about education. Both segments dropped a full 7 percentage points among those who said it had impacted their thinking “to some degree.” At 26%, “definitely” was the next-highest ranking opinion reported among both Opportunists and Planners—a single percentage point lower.

Both attitudinal segmentations were least likely to choose “not at all,” with no more than 13% among Opportunists or Planners. This also represented the greatest jump between segments with a 13-percentage point drop.

At first glance, Opportunists and Planners might appear to be look-alike audiences for marketers. A closer look reveals that while percentages within this section match, each segment retains distinct overall attitudinal differences.

The pandemic increased interest in online school

Changing one’s thinking about education during the pandemic is one thing. How it changed among each attitudinal segment for Opportunists, Worriers and Planners is quite another. That’s why we asked survey respondents to consider 10 ways COVID and the recession might have affected their thinking about education, and to what degree.

Among Opportunists, 53% noted “more interest in online education,” the highest percentage recorded for any of the 10 questions posed. Worriers, at 37%, were second most likely to indicate “more interest in online school,” while Opportunists not only ranked highest, but significantly higher with a 16-percentage point spread between them. Planners were least likely, at 25%, to indicate “more interest in online school.”

Thinking changed differently among Worriers, Opportunists and Planner

Each attitudinal segment also indicated other significant changes to their thinking about education based on COVID and the recession with only two ties, one of which encompassed all three groups.

Opportunists, at 47%, were next-most likely to “consider further education” with 44% of them expressing a desire to “make more money.” They were least likely, at 15%, to report being “left without a job.”

Worriers, at 44%, were most likely to select “make more money,” which coincidentally mirrors the second-ranked percentage of Opportunists who selected the phrase.

Worriers broke away from Opportunists—and even more so from Planners, with 36% of them stating that COVID and the recession led to a desire to “try something new.” Opportunists accounted for 28% with the same new desire, with Planners making up the remaining 19% of respondents so inclined.

Planners were most likely to have changed their thinking about the phrase “make more money,” with 27% of them in agreement. There’s not a lot of differentiation between the weight this group of thinkers puts on the phrases “more interest in online school,” “consider further education,” and “consider changing careers,” with each registering 25% of Planners. The phrase “pursue different work” was right behind at 22%, which coincidentally was matched in a three-way tie among all attitudinal segments identified in the study.

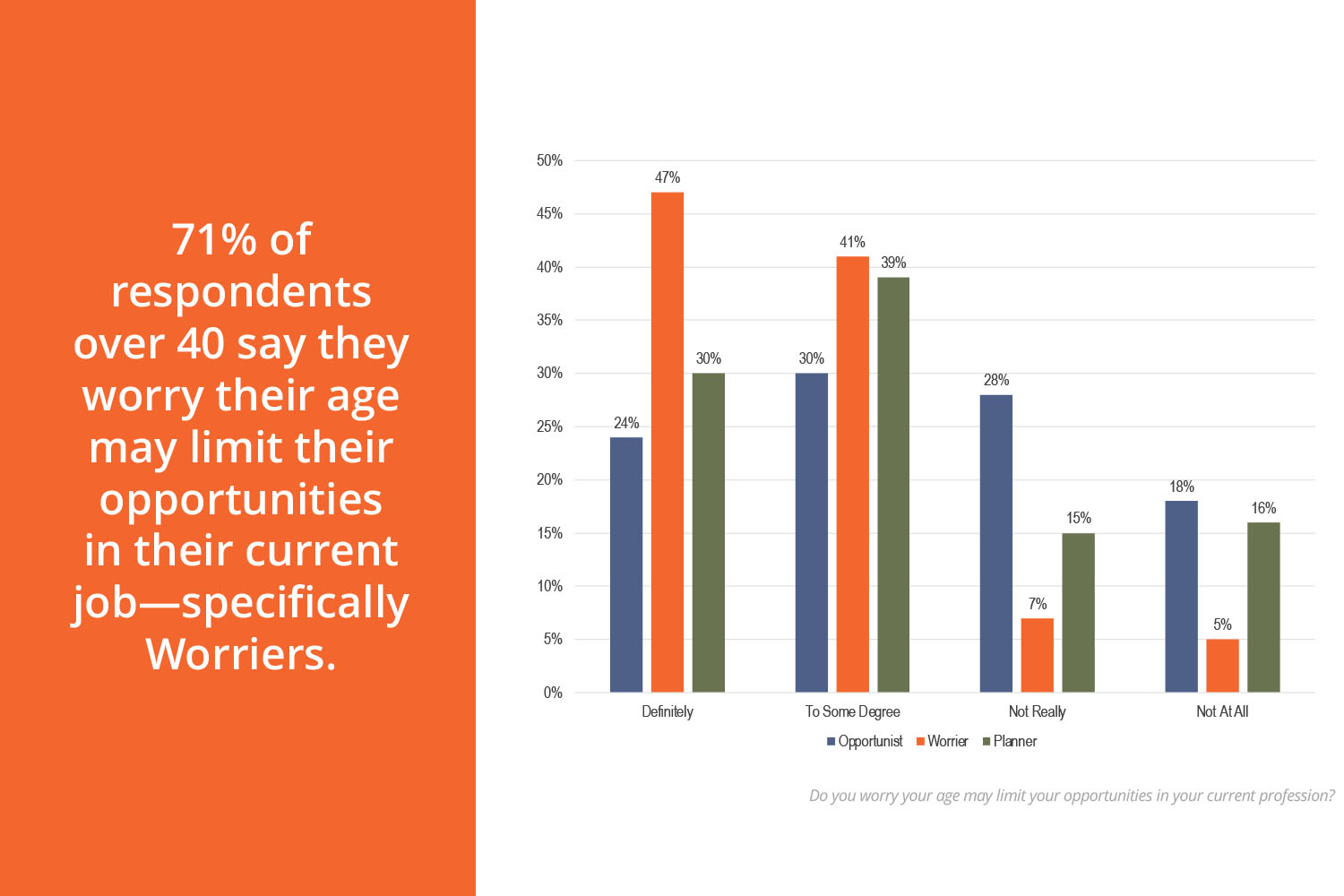

Worriers, especially older than 40, fear limited job advancement opportunities

Compared to their counterparts, Worriers are more likely to worry about, well, anything. Of those who are 40 or older, 71% said they “definitely” or “to some degree” worry about their age limiting their career opportunities at their current job. Only 12% of Worriers said it was “not really” a concern or “not at all.”

Planners were next-most likely to indicate concern about upward mobility at work during the pandemic, with 39% indicating they worry “to some degree” and 30% who said they “definitely” worry about not having opportunities for advancement.

Opportunists, while least likely at 30% to worry "definitely" or "to some degree," were most likely to identify with the latter phrase. They ranked only 2 percentage points lower at 28% for the phrase "not really" and another 4 percentage points lower at 24% for "definitely." At 18%, Opportunists were least likely to worry "not at all" about being able to grow within their current profession.

Partner with an experienced adult education marketing agenc

Reaching patients who hold each of these beliefs—and targeting them one at a time for the best effect—requires attitudinal research. Going it alone, especially in a post-pandemic market, can be risky for educational institutions. Choosing the best agency to partner with for consumer education marketing messages for adult learners has never been more important.

Consumer attitudes are changing, and you need an experienced team with significant industry experience combined with access to developing consumer insight based on what your audience of learners believe.

You’ll find just that with LAVIDGE.

In fact, education marketing is a core category at LAVIDGE. We invest in primary research to keep abreast of consumer shifts in the education industry, launching our first education study in 2018.

Finally, because our strong roster of current and past clients represents a wide range of organizations in the education category including West-MEC, Arizona State University, CampusLogic, Rio Salado College, and International Sports Sciences Association make it clear that LAVIDGE is an agency you can trust.

We’d love to bring you into the fold.

To learn more about our Adult Education attitudinal research study, contact Dave Nobs .