Need fresh thinking? Help is a few keystrokes away.

Define and Conquer

No self-respecting ace would throw the first pitch without a solid game plan, and neither should you.

Because, in sports marketing, using the right pitch to secure the most ticket sales is just as important to the financial success of the team as it is to have a strong arm on the mound who can hit it up and in.

But no two fans are exactly alike. Even sponsors have needs of their own. Using a generic pitch for every marketing message based on what’s most likely to connect with the average buyer is a bit like never using a changeup on the hill. You’re not likely to rack up ticket sales any more than throwing a predictable stream of meatballs will lead to a shutout.

Much like any great Major League Baseball pitcher sizes up the player at bat, each marketing windup must be strategized just as carefully to be executed with similar precision. Enter audience segmentation.

Sports marketers segment audiences to:

- Increase ticket sales

- Improve marketing ROI

- Expand knowledge of fans and their motivations

- Drive sponsorship revenue

By following a few steps you can create and leverage specific customer groupings to your organization’s advantage.

Define your best customers

Every professional team has tickets to sell. The needs and desires of specific buyers, however, can vary greatly. Consider the difference between the person who buys tickets to a single game to one who buys season tickets. Or the guy or gal who doesn’t mind enjoying a team-branded hot dog and a cold beer in the cheap seats to those who expect to watch the game from a suite—complete with a variety of catered foods and drinks.

Does your team have an easy time filling the suites but struggle to fill the so-called nosebleed sections during weeknights? Or, are the regular seats more consistently sold out with fans choosing them even when higher-end option seats or suites are still available?

By identifying your best customers you can focus your best efforts on keeping them engaged. Pay attention to feedback so you know if their needs are being sufficiently met and where you have opportunities for improvement.

You’ll also uncover areas of weaknesses. Decide which to cut loose and which have the potential to become strengths.

Know when to swipe right

Pairing a sports organization with a potential sponsor is a little like online dating. Brand alignment has to be obvious enough for each party to swipe right, opening the door to court each other for a possible business relationship.

Take Old Dominion Freight Line, Inc. (ODFL), the official freight carrier of Major League Baseball (MLB). ODFL’s website states the organizations share similar values. Baseball is America’s pastime, has a rich history of growth and enjoys deep connections with fans, the site further states, adding that Old Dominion is also a success story with a “strong reputation built on reliability and keeping promises.”

In short, both brands value hard work, exceptionalism and performance.

Last summer, as part of the sponsorship agreement, ODFL modified one of its 28-foot truck trailers with plexiglass windows. Then they stuffed it with thousands of baseballs. The correct guess of just how many balls it took to fill the truck earned one fan two free tickets to last fall’s World Series.

Last summer, as part of the sponsorship agreement, ODFL modified one of its 28-foot truck trailers with plexiglass windows. Then they stuffed it with thousands of baseballs. The correct guess of just how many balls it took to fill the truck earned one fan two free tickets to last fall’s World Series.

A year later, the partnership is going strong. Only instead of all eyes being on one truck with thousands of branded baseballs, 30,000 Old Dominion trucks roll America’s highways bearing the MLB logo. Inside might be anything from MLB team equipment on the way to a game to personal items and furniture packed by families moving to new homes. (We’re betting that on game day more than a few of those families can be found among baseball fans cheering at home or in the stands.)

Landing one sponsorship can lead to others—especially when the values among all organizations are closely aligned. In addition to the MLB, ODFL sponsors several of its teams including the Boston Red Sox, Chicago Cubs, Chicago White Sox, Kansas City Royals, Los Angeles Angels, New York Mets and Texas Rangers.

With that in mind, it’s certainly worthwhile taking a look at who is sponsoring neighboring teams with a similar brand to see if you can piggyback on an existing relationship.

Study market demands

Get a handle on potential market demand by customer type. Ideally, you should look beyond basic demographics such as age, income level, gender and geographic location. Conducting psychographic research will identify behaviors, thoughts, feelings and beliefs which motivate segments of your audience. By uncovering what they want, and also what might be causing them angst, you can make needed adjustments to not only gain new fans but to avoid losing the ones you have.

Ignoring pain points can be costly. Reacting without being fully informed can also inflame delicate issues already in play. Perhaps that’s why the National Football League declined to take a broader stand on players taking a knee during the national anthem last season, deferring in large part to local owners throughout the year. It wasn’t until late May the NFL adopted a policy which allows the protests—although those who participate could be subject to a fine.

By mid-summer, the New York Jets announced the football club will pay any related fines its players incur. It’s a solution which works well on the East Coast.

Meanwhile, in Texas, a different breed of fans expect a different approach. So the Dallas Cowboys announced going into the 2018-2019 season that standing during the national anthem is an expectation of employment.

Whatever the sport and whatever the issue, appropriate research is the best way for clubs to intelligently cater to their fans—oftentimes before potential misunderstandings occur—and if not, before things get out of hand.

Identify and nurture growth opportunities

Even the best markets can eventually tap out. Take a look at your customer personas to identify growing market segments. What motivates them, and how can you nurture them by providing what they need so their support will grow increasingly sustainable?

Let’s say you have identified affluent families as a growing market segment. You discover that what motivates them is the desire for more family time. Creating family four-packs including admission, kid-friendly concessions complete with a patio area and a family playground might be just the ticket to get them to come. Offering incentives to plan to attend multiple dates at once just might hook newcomers into becoming regular attendees.

A completely different package could be available for a segment more interested in a laser-like focus on what’s happening on the field. Knowing that many families are likely to be seated far away might also be a selling point if sharing the game with cookie crunchers isn’t their thing.

Either way, it will be important to determine how to most effectively reach your top customer markets.

Analyze and optimize

Once you’ve identified an audience segment and reached out to them, make sure to pay attention to whether you’ve hit your mark. Feedback might reveal that your messages have landed with an unintended audience. If they resonate, that’s fine. Just make sure you understand why.

If your efforts aren’t as effective as you’d like, change up your marketing tactics, switch messaging channels or alter the time of day when your ads deploy. Then reassess and repeat until you find the sweet spot for each audience segment.

Need help?

Not sure where to start? No problem. LAVIDGE experts in planning and strategy can help you navigate the process.

To learn more, give us a call at 480.998.2600 or send email to [email protected].

You’re probably not using this resource…

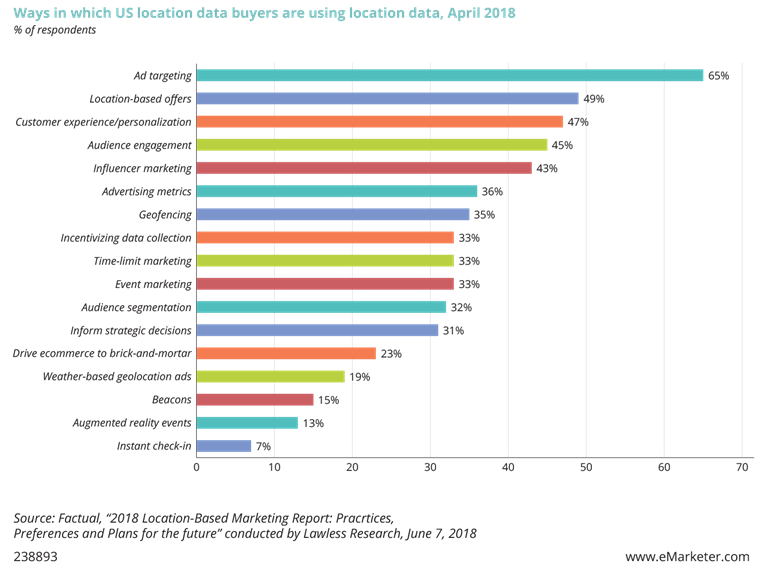

Do you buy location data about your customers?

If so, perhaps you are among the 32 percent of US buyers who use it to segment their audiences. If not, you might be ignoring valuable data which could help you better understand effective ways to group your customers

Courtesy of eMarketer.com, here’s a look at how data buyers use the information they purchase about customer location:

Methodology: Data is from the June 2018 Factual "2018 Location-Based Marketing Report: Practices, Preferences and Plans for the Future" conducted by Lawless Research. 700 US location data buyers were surveyed online during March 22-April 15, 2018. Respondents were manager-level or above, with 534 from consumer brands and 166 from advertising/marketing agencies. The survey was hosted by Qualtrics and Cint provided respondents from their aggregated research panel. Tests of significance were conducted at the .01 and .05 levels (99% and 95% probability, respectively, that the difference is real and not by chance). Factual is a location data platform for mobile advertisers, developers and enterprises.

2018 Southwest Sports Marketing Report

This article is a brief abstract of our exclusive and authoritative study that takes the guesswork out of sports advertising and marketing. Rather than speculating about what will drive consumers to action, we've asked them.