Need fresh thinking? Help is a few keystrokes away.

Consumers Like to Keep it Casual When it Comes to Sports and Fitness

This article is a brief abstract of our exclusive study that takes the guesswork

out of sports sponsorship, advertising and marketing.

Download the complete 2018 Southwest Sports Marketing Report

Americans love to talk a big game. We support our favorite athletes by following their standings and attending their events. We emulate them by consuming the products and services they say they use or prefer most.

Many fans even try to look like their athletic heroes by wearing officially licensed team jerseys, hats, socks, and just about anything else they can get their hands on. By proudly wearing a player’s number and walking in their brand of shoes, Americans are not only connecting with but assuming—at least to some level—the identities of sports idols such as LeBron James or J.J. Watt.

It turns out, however, that when it comes to America’s love affair with fitness we’re quite the flirts. Making the commitment to work out or play sports on a regular basis is just a bit much—for most of us. Physical activity is, in fact, on the decline. Even so, the largest focus of activity for those who are active, according to the Physical Activity Council’s 2018 Participation Report, is fitness sports.

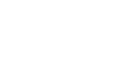

Almost 30% of respondents said they casually or intermittently work out or play sports. Female respondents were slightly more likely at 33% to casually or intermittently work out or play sports, than males who are 25% as likely to do the same. As long as these casual consumers continue to engage with fitness on some level, including financially, sports marketers can cash in on Americans’ on-again, off-again fling.

Of course, there will always be a handful of hardcore fitness fanatics and those who regularly participate in multiple athletic activities. Those two groups combined only accounted for 8% of study respondents. They are loyal to a fault, however, so capturing their business is important as it is likely to be repeated. Less-active adults often look up to them as the brand experts and tend to follow their lead in buying decisions.

Of course, there will always be a handful of hardcore fitness fanatics and those who regularly participate in multiple athletic activities. Those two groups combined only accounted for 8% of study respondents. They are loyal to a fault, however, so capturing their business is important as it is likely to be repeated. Less-active adults often look up to them as the brand experts and tend to follow their lead in buying decisions.

Those who commit to fitness without making it a full-on obsession—undoubtedly another sweet spot for sports marketers—accounted for 18% of our study respondents. Because they form a larger pool of consumers than that of the heavy-hitters, this group represents a significant marketing opportunity as well.

Physical activity correlates with higher education

Respondents with some college credit and those who are retired self-identified as being more “actively involved in a specific sport or activity” than other groups.

While only 18% of respondents identified with the same statement, more than 38% of those who have earned at least some college credit felt it described them best.

Being retired had a similar effect on physical activity. Almost 22% of retired respondents are more actively involved in a specific sport or activity than those who work full-time, part-time or are unemployed. One retiree respondent noted a preference for activities which take place in exercise classes offered by a trained instructor. Such classes keep the body in balance, prevent falls and strengthen muscles and joints, the respondent said, adding that they also provide a fun and happy atmosphere with good company.

For retirees, the correlation ends there.

Education continued to play a role with 8.2% of college graduates reporting being involved in multiple sports or activities, compared to 5.5% overall and only 2.7% of those with a high school education or less.

2018 Southwest Sports Marketing Report

This article is a brief abstract of our exclusive and authoritative study that takes the guesswork out of sports advertising and marketing. Rather than speculating about what will drive consumers to action, we've asked them.